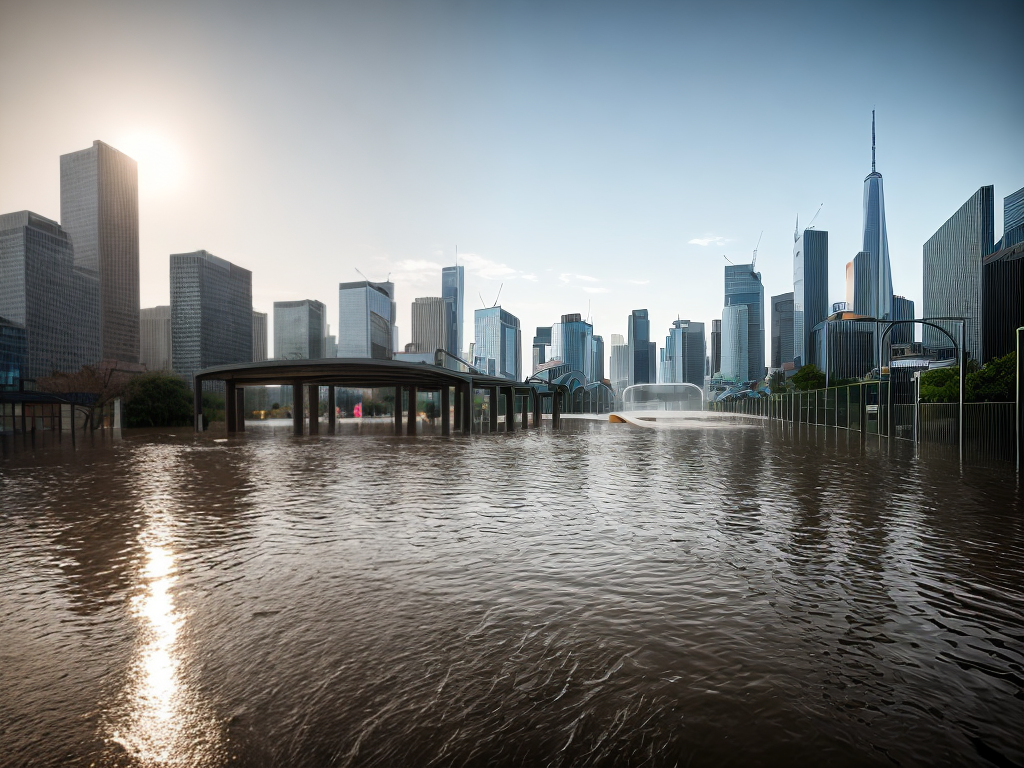

Welcome to our comprehensive guide on the challenges and shortcomings of flood insurance for homeowners. In this article, we will delve into the rising costs and limited coverage provided by flood insurance policies, and discuss the implications for homeowners facing the increasing risk of flooding. As flood events become more frequent and severe, it is crucial for homeowners to understand the limitations of their insurance coverage and explore alternative solutions.

The Current State of Flood Insurance

Flood insurance is designed to protect homeowners from the financial burden of flood damage. However, the existing system is facing numerous challenges that hinder its effectiveness. One of the main issues is the rising costs of flood insurance premiums. Over the past decade, insurance rates have skyrocketed, leaving many homeowners struggling to afford coverage. This increase in premiums is largely attributed to the growing frequency and severity of flood events, as well as the higher costs of rebuilding and repairing damaged properties.

The Inadequacy of Coverage

While flood insurance is meant to provide comprehensive coverage, many homeowners are discovering that their policies fall short when it comes to protecting their investments. Standard flood insurance policies typically cover only the structure of the home and exclude coverage for personal belongings, such as furniture, appliances, and valuable items. This limitation can leave homeowners with significant financial losses if their belongings are damaged or destroyed in a flood.

Furthermore, the coverage limits of flood insurance policies often do not align with the actual cost of rebuilding or repairing a home. In many cases, the coverage provided is insufficient to cover the full extent of the damage, leaving homeowners with a substantial financial burden. This is especially problematic for homeowners in high-risk flood zones, where the likelihood of severe damage is greater.

The Role of Government Programs

In the United States, the National Flood Insurance Program (NFIP) plays a significant role in providing flood insurance coverage. However, the program has faced criticism for its limited scope and financial instability. The NFIP operates under the supervision of the Federal Emergency Management Agency (FEMA) and offers flood insurance policies to homeowners in participating communities.

The Financial Strain on the NFIP

One of the key challenges faced by the NFIP is its financial sustainability. The program heavily relies on premiums from policyholders to cover flood damage claims. However, the increasing frequency of flood events, coupled with the rising costs of rebuilding, has put a strain on the program’s finances. As a result, the NFIP has accumulated a substantial amount of debt, leading to concerns about its long-term viability.

The Need for Reform

Given the limitations and financial challenges of the NFIP, there is a growing consensus that reform is necessary to address the shortcomings of the current flood insurance system. Efforts are being made to improve the accuracy of flood risk assessments and update flood maps to reflect the changing landscape. Additionally, there is a push for increased transparency and better communication between homeowners, insurance providers, and government agencies.

Exploring Alternative Solutions

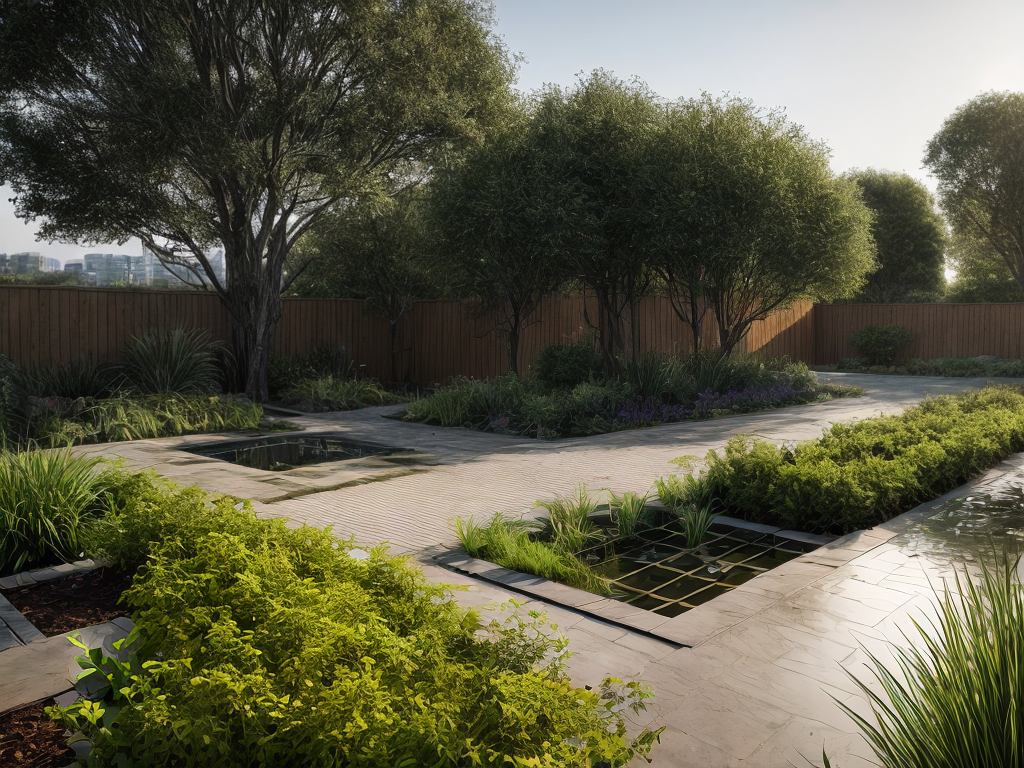

As homeowners face the inadequacies of traditional flood insurance, many are seeking alternative solutions to protect their properties. One option gaining traction is private flood insurance. Unlike the NFIP, private insurers have the flexibility to offer tailored coverage options, including coverage for personal belongings and higher coverage limits. However, it is important for homeowners to carefully evaluate the terms and conditions of private policies to ensure they meet their specific needs.

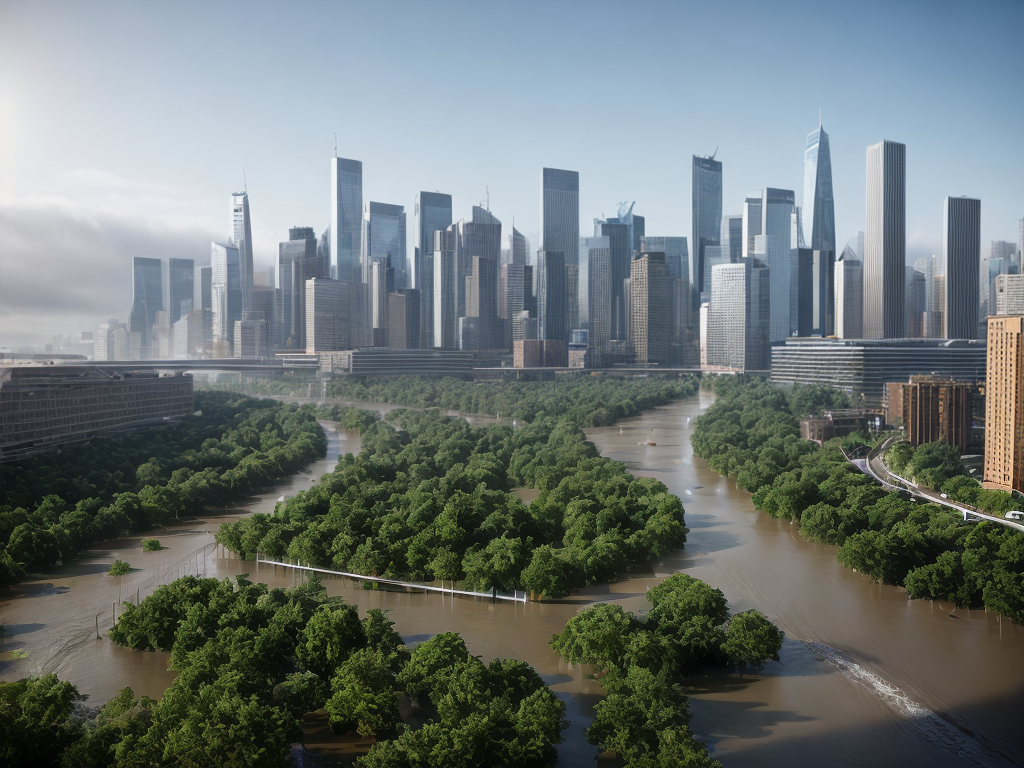

Another approach is investing in flood mitigation measures. By implementing flood-resistant building techniques, elevating homes, or constructing barriers, homeowners can reduce the risk of flood damage and potentially lower their insurance premiums. These proactive measures not only enhance the safety and resilience of homes but also contribute to the overall community’s flood preparedness.

Conclusion

In conclusion, the current state of flood insurance is failing homeowners in several ways. Rising costs, limited coverage, and financial instability of government programs have left many homeowners vulnerable to the devastating effects of flooding. It is crucial for homeowners to understand the shortcomings of their insurance policies and explore alternative solutions to protect their investments. By advocating for reform, considering private flood insurance, and implementing flood mitigation measures, homeowners can better prepare themselves for the challenges posed by rising waters and rising costs.